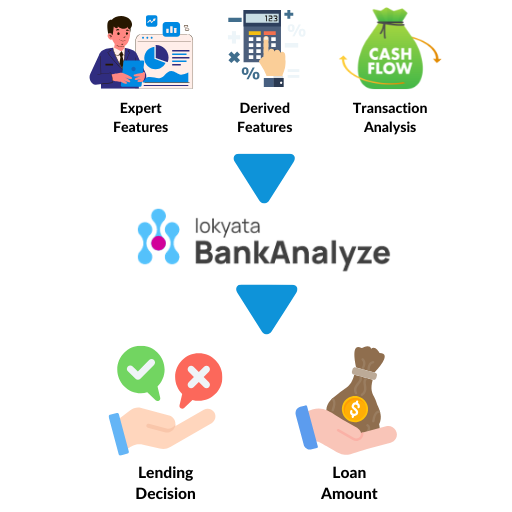

Cash Flow Analysis for Lending

Automatically assess loan applicants' financial health and behaviors in real-time using AI.

AI-Driven CashFlow Analysis

- Bank statements are a rich source of data that facilitates cash flow analysis

- Fast and accurate transaction categorization is essential for robust cash flow analysis

- Categorization facilitates knockout rule enforcement, modeling, and decisioning

- Reduce human errors, boosts efficiency, and lowers costs

- KPIs, Rules, Scores, Trends Drive Fully Customizable Decisions Workflows.

- Ensure Consistency, Fairness, and Objectivity while Instantly Evaluating Up to 2 Years of Account History.

Modeling Borrower Risk

- Accurate transaction categorization and income and debt calculations facilitate robust machine-learning models

- Lokyata has combined years of experience in creating expert models to create features optimal for modeling borrower risk

- We also understand that our models have to have a level of transparency in order to indicate reasons for rejection