Fair, Inclusive Credit for All Americans

Our team is redefining the credit landscape, enabling lenders to grow profitably while making a meaningful impact on financial inclusion.

Let's build a more inclusive financial system together

Lokyata comes from Sanskrit, meaning “for the people” and “of the world”—a philosophy that drives everything we do. With over 45 million Americans unable to access fair credit, we’re on a mission to change that.

By combining cutting-edge AI technology with lender-driven decisioning, Lokyata helps financial institutions expand access to credit responsibly. Our platform empowers lenders to make smarter, faster, and more inclusive lending decisions, ensuring more families get the financial resources they need.

Lokyata was built on the belief that technology should empower, not exclude. We are redefining the credit landscape, ensuring lenders can grow profitably while making a meaningful impact.

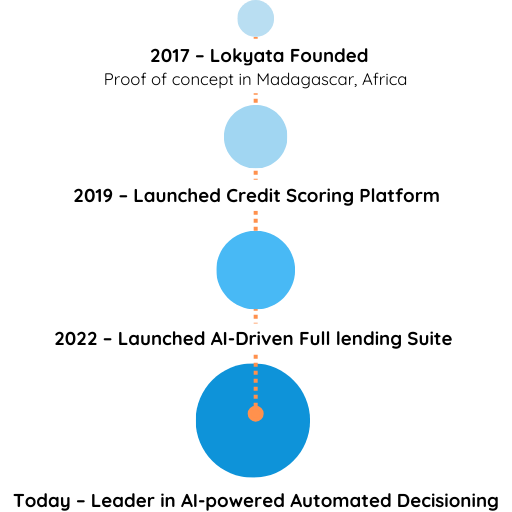

A Timeline of Innovations and Impact

A Team with Expertise and Passion

We’ve spent decades in lending—both in the U.S. and around the world—so we

know the challenges borrowers and lenders face firsthand.

Our team isn’t just made up of experts; we’re driven by a passion for using data science to create real change. We believe everyone deserves access to fair credit and are here to make that happen.

At Lokyata, access, inclusion, and impact aren’t just words—they’re the heart of everything we do. They guide our decisions, fuel our innovation, and keep us focused on what matters most: helping more people get the financial support they need.

Lokyata's AI-Powered Solutions

FRAUDBLOCK

Sophisticated Fraud Detection

- Integrated Lead Screening, AI Fraud Models, and Fraud Consortiums.

- Plug and Play with Popular

- Alt-Data Providers and Credit

- Reporting Agencies

- Reduce credit bureau costs

LEADBUY

Smarter Lead Buy Decisioning

- Self-Service Lead Buy Workflow Automation

- AI-based lead analysis based on tens of thousands of loans

- Include customized rules-based lead screening according your rules

BANKANALYZE

Smarter Lead Buy Decisioning

- Self-Service Lead Buy Workflow Automation

- AI-based lead analysis based on tens of thousands of loans

- Include customized rules-based lead screening according your rules